Hairy Tax Questions

/

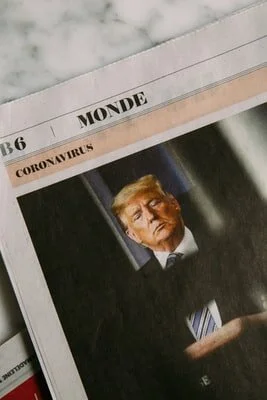

Sunday night, the New York Times released a bombshell story analyzing 18 years of what they characterized as Donald Trump's "tax return information." We're not going to touch the substance of the article — that's what Twitter and Facebook are for. But one specific deduction stuck out like an unruly cowlick, and we couldn't help but say a few words.

Donald Trump has probably taken more grief for his hair than for anything else about him. He doesn't seem to have enjoyed a good hair day since his salad days partying at New York's Studio 54. His former fixer, Michael Cohen, claims it's a result of botched hair implant surgery back in the 1980s. (Of course, Michael Cohen is also currently serving out a three-year prison sentence in home confinement, so you'll be forgiven for taking his words with more than a pinch of salt.)

And yet, Trump's tax returns indicate he deducted $70,000 for hair styling while appearing on The Apprentice. Leaving aside the question of whether he got his money's worth, the issues seem simple. Does hair styling count as an "ordinary and necessary" cost of carrying on that particular trade or business activity? And if so, is $70,000 a reasonable amount to deduct?

It's well-established that uniforms and work clothes are deductible, unless they're suitable for ordinary street wear. Under that same logic, makeup and hair styling costs are deductible if they're incurred specifically for work-related photo shoots, performances, or similar occasions. But you can't write off the cost of your street makeup just because you also wear it for work. And you can't deduct the cost of a haircut that you're just going to wear after your appearance.

As for the $70,000, Trump appeared in 96 episodes of The Apprentice, and each of those episodes was filmed over multiple days. That means a lot of time in the stylist's chair. Suddenly $70,000 isn't such a stretch. Trump isn't the only politician to drop serious coin on his hair: Bill Clinton famously paid $200 for a haircut on Hair Force One (see what we did?), and John Edwards used campaign contributions to pay for two $400 trims at a salon off Beverly Hills' famed Rodeo Drive. Of course, we don't know that either of those men tried to deduct those cuts.

The Tax Court offers a less optimistic perspective. From 2005-2008, Anietra Hamper, an anchor at Columbus Ohio's NBC4, wrote off $167,356 for a variety of expenses, "including manicures, teeth whitening, gym fees, sportswear, bedding, cotton bikini underwear and thongs she insisted were necessary to do her job." The Court ruled that the cost of maintaining an attractive appearance is a personal expense, even though her employer required her to maintain a neat, professional, and conservative appearance (and apparently to avoid panty lines).

Having said all that, it appears that Trump can deduct the cost of his on-set hair styling: shampoos, blowouts, and lots and lots of product. So much product. As is so often the case, if this is a scandal, the scandal lies in what's legal. The statute of limitations for the IRS to audit that particular expense has long since passed. And even if they were to trim that deduction, he would simply owe the tax plus interest. There's nothing criminally fraudulent about Trump's accountants resolving a judgment call in his own favor (although there might be about that combover).

Voting has already started for the 2020 presidential election. We urge you to make your voice heard at the ballot box. We'll be here, no matter who wins, to help your taxes keep looking as neat and trim as possible!